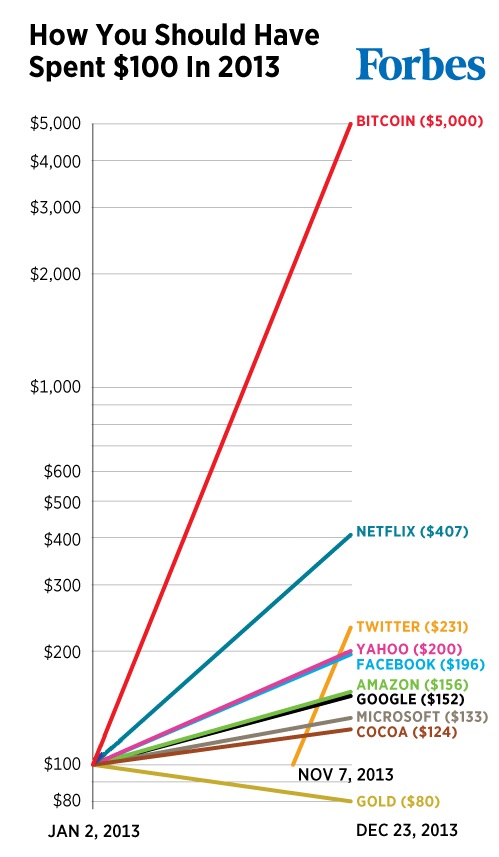

I wanted to record my thinking process in 2013 occasionally, but it is already almost over without much results. It is better late than never, so I’m attempting at least an annual report here. First, let’s see a chart below from Forbes’ article summarizing notable value changes: How You Should Have Spent $100 in 2013.

This year, I was exclusively looking at the tech stocks, and the chart shows that that choice would’ve rewarded handsomely regardless of specific selection – I didn’t think much of digital currencies like BitCoin or LiteCoin. Below is my watchlist that has a few more information for this year:1 2

- TSLA (Tesla Motors) – $438.17

- YHOO (Yahoo!) – $204.27

- FB (Facebook) – $202.45

- AMZN (Amazon) – $155.07

- GOOG (Google) – $153.22

- AAPL (Apple) – $104.54

- MSFT (Microsoft Corporation) – $137.01

Considering KOSPI didn’t move much this year, my choice to invest in U.S. tech companies was a primary reason for gains. However, I also kept a few principles that may had some contributions:

- Technology is still changing rapidly, so today’s winners will be quickly outpaced without innovations. So I’ll invest in companies that are not afraid of innovations and execute well.

- I’ll not attempt to benefit from short-term tradings. So, I’ll not check prices more than once a day, and if I decide to make a transaction, I’ll trade on the market price. (trading itself is costly regarding my most precious asset: time).

Because of the first principle, I deeply cared about who the CEO was. Incompetent CEOs don’t understand innovations at all. In contrast, excellent CEOs show aspiring visions to allure exceptional talents and run the company to keep them working at full potential. For example, Amazon’s Drone and Google’s Boston Dynamics were fascinating for world-class workers in robotics. Yahoo! is also paying more than aggressively to get people they want.3

Because of the second principle, I made five transactions in total: I bought TSLA twice, sold once, and bought YHOO twice. Considering my minimal cash, I think it was a reasonable number. I didn’t bother to check prices for months when I was busy.4

Now, what would I do in 2014? First, the market seems to move faster than I expect. For example, Twitter was rumored to be public at $11B, but it had already passed the $40B mark. So the movement seems a bit over-hyped (and 2013 gain is potentially pure over-excitement.) Nevertheless, I’m still learning, so I will try to control my greed and stick to the principles I believe in.

-

To reduce noise, I used the average closing prices of the first three trading days and the most recent three trading days. ↩︎

-

I added MSFT because I expected it to fall, so the result was somewhat surprising. ↩︎

-

I found an interesting article from WSJ: Profitable Learning Curve for Facebook CEO Mark Zuckerberg. Even though Zuckerberg seemed neutral to stock price fluctuations, he was actually worried about the drop. It was even more interesting to learn that the reason was that employees might leave as their shares would’ve been worth less (not his own assets.) This story shows how talent attrition is a crucial question for exceptional CEOs. ↩︎

-

Here’s a relevant quote from Warren Buffet. “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years. As far as you are concerned, the stock market does not exist. Ignore it. Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.” ↩︎