Reid Hoffman, born in 1967, has a remarkable career as a founder and CEO of LinkedIn and an angel investor. In addition, he is well-known as a Paypal Mafia and currently working as a partner in a VC called Greylock Partners. Although not many people would recognize him outside Silicon Valley, Forbes selected Hoffman as one of the 71 most influential people in 2012 (out of 71 billion). Recently, he authored a book 《the start-up of you》, so I wanted to take notes on memorable parts.

You can be a genius at analyzing which companies to buy, but unless you have the patience and the courage to hold on to the shares, you’re an odds-on favorite to become a mediocre investor. It’s not always brainpower that separates good investors from bad; often, it’s discipline.

I found this quote the most resonating because it clearly showed the necessary attitude for an investor. The market price is beyond human’s control or understanding: price can fluctuate on highly uncorrelated news, decrease on seemingly-good information, and suddenly spike after a long hibernation. Furthermore, the market typically refers to highly filtered public companies, so I suspect angel investments are incredibly volatile in the short term. For example, even though Facebook is one of the most remarkable businesses in human history, it took eight years to go public, with many existential risks in the middle. Thus, even after the hard work of finding a great opportunity, you need perseverance and courage to hold the position to be a successful investor.

Take intelligent and bold risks to accomplish something great. Build a network of alliances to help you with intelligence, resources, and collective action. Pivot to a breakout opportunity.

Stockpiling facts won’t get you anywhere. What will get you somewhere is being able to access the information you need, when you need it.

After the attitude, these two quotes teach how to act as an investor: take “intelligent and bold” risks and align yourself with the great opportunity. First, the “intelligent risks” suggest carefully evaluating the upside and downside. Then, the “bold risks” means taking definite actions after the evaluation.

Success begins with opportunities. You can never be certain. Golden opportunities are not wrapped in pretty packaging with a clear label; killer job opportunities are rarely advertised on job boards.

This quote adds a little more explanation about risks.

Netflix stays nimble and iterates, always in the test phase. We call this mindset “permanent-beta.”

“Permanent-beta” state is noteworthy. It has duality. First, “beta” means it is incomplete and has room for improvement. Since this is only “beta,” you can even abandon whatever you have achieved and shift toward a much better state when it makes sense. Second, it has an optimistic attitude that you can be much better than you are now. It shows a will to continuously improve toward a much larger vision instead of passively accepting inertia. How inspiring is that!

Making a decision reduces opportunities in the short run, but increases opportunities in the long run. The economy, politics, and job market of the future will host many unexpected shocks. In the sense, the world of tomorrow will be more like the Silicon Valley of today: constant change and chaos. So does that mean you should try to avoid those shocks by going into low-volatility careers like health care or teaching? Not necessarily. The way to intelligently manage risk is to make yourself resilient to these shocks by pursuing those opportunities with some volatility baked in. In the short run, low volatility means stability. In the long run, though, low volatility leads to increased vulnerability. because it renders the system less resilient to unthinkable external shocks.

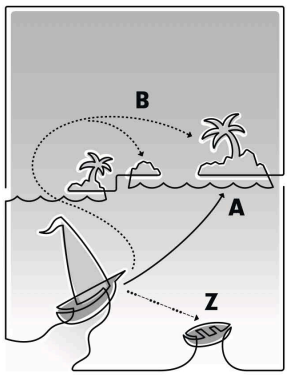

Reid Hoffman suggests the “ABZ” strategy to take intelligent risks. Here, “A” refers to the target, the ideal state from the current view. “B” shows a pivoted target you eventually reach after multiple iterations toward “A” as unknown risks are clarified. Instead of random targets like “C” or “D,” “B” is a realistic target that you can reach while aiming for “A.” Lastly, “Z” is the safety buffer. Even when the journey completely fails, you need a minimum place where you can plan for the next round. By having “Z,” you can be more aggressive at setting “A” and “B.” For example, with some cashable assets aside, you can still plan for the subsequent investments even when both “A” and “B” failed.

The book shows excellent perspectives for tech investors, and I believe the lessons apply well to a much larger audience. Without your strategy, you will quickly become a replaceable commodity in the rapidly changing world. ∎

Credits 🔗

Above pictures are from the author’s webpage.